Action 4 - OECD BEPS

Par un écrivain mystérieux

Last updated 15 juillet 2024

OECD Tax Talks #4 - Centre for Tax Policy and Administration

Home OECD iLibrary

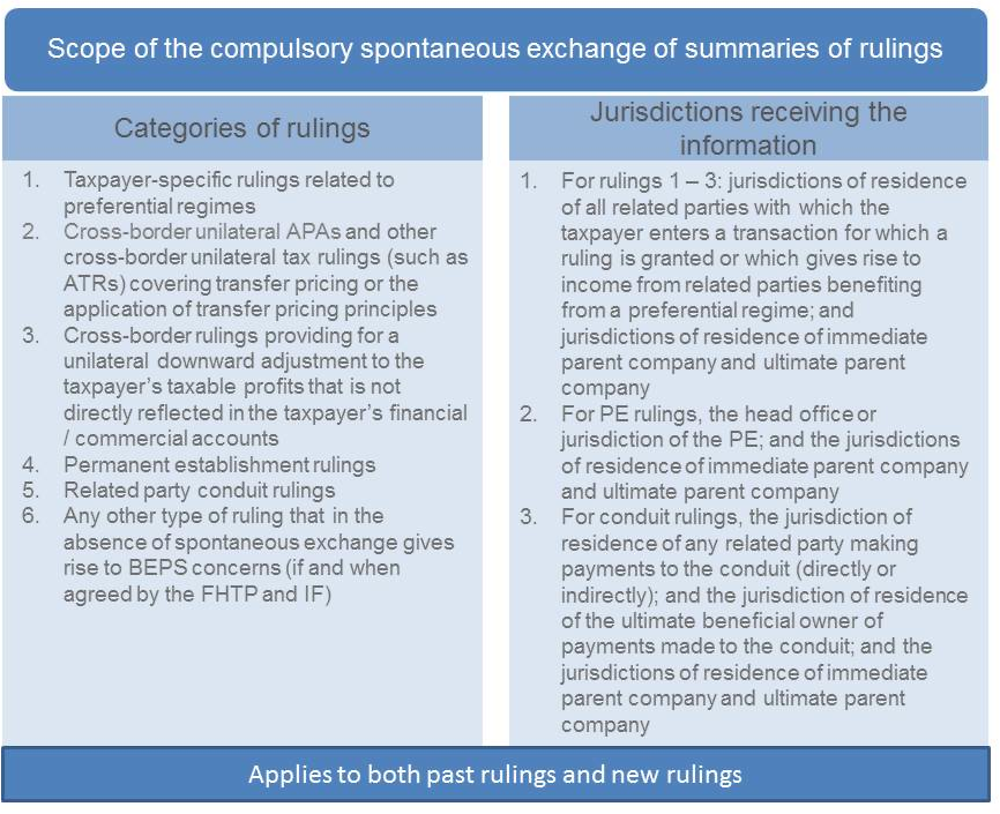

Overview of the OECD/G20 BEPS Project

Action 5 - OECD BEPS

Addressing base erosion and profit shifting (BEPS) is a key priority of governments. In 2013, OECD and G20 countries, working together on an equal

OECD/G20 Base Erosion and Profit Shifting Project Transfer Pricing Documentation and Country-by-Country Reporting, Action 13 - 2015 Final Report

INSIGHT: Transfer Pricing of Financial Transactions, Stuck between a Rock and a Hard Place

Action 4 - OECD BEPS

PDF) Implementing OECD BEPS Action Plan 4 in Indonesia, a comparative study with Malaysia

Addressing base erosion and profit shifting (BEPS) is a key priority of governments. In 2013, OECD and G20 countries, working together on an equal

OECD/G20 Base Erosion and Profit Shifting Project Designing Effective Controlled Foreign Company Rules, Action 3 - 2015 Final Report

OECD released Transfer - IBFD Library & Information Centre

The impact of BEPS Action 7 on operating models

Base Erosion and Profit Shifting (BEPS) project

VCM on “OECD BEPS Action plan 5:Economic Substance Regulation and NBF Institutions:Laws- 02042022

BEPS & the OECD: Taxation of the Digital Economy

Overview of 15 OECD BEPS Action Plans - ICAI International Tax Conference

Recommandé pour vous

Ready, set, action! DJI announces the Osmo Action 4: Digital14 Jul 2023

Ready, set, action! DJI announces the Osmo Action 4: Digital14 Jul 2023 Fauteuil Roulant Manuel Invacare Action 4NG - Invacare France14 Jul 2023

Fauteuil Roulant Manuel Invacare Action 4NG - Invacare France14 Jul 2023 Achat Invacare Action 4 NG dossier inclinable ou pliant fauteuil14 Jul 2023

Achat Invacare Action 4 NG dossier inclinable ou pliant fauteuil14 Jul 2023 Fauteuil roulant Invacare Action 4 NG - Vimedis - Fauteuil roulant14 Jul 2023

Fauteuil roulant Invacare Action 4 NG - Vimedis - Fauteuil roulant14 Jul 2023 Test DJI Osmo Action 4 : GoPro n'a qu'à bien se tenir - Les14 Jul 2023

Test DJI Osmo Action 4 : GoPro n'a qu'à bien se tenir - Les14 Jul 2023 DJI Osmo Action 4 - Set the Tone - DJI14 Jul 2023

DJI Osmo Action 4 - Set the Tone - DJI14 Jul 2023 DJI Osmo Action 4 vs DJI Osmo Action 3: What's the difference?14 Jul 2023

DJI Osmo Action 4 vs DJI Osmo Action 3: What's the difference?14 Jul 2023 DJI Osmo Action 4 : GoPro dans le viseur - Les Numériques14 Jul 2023

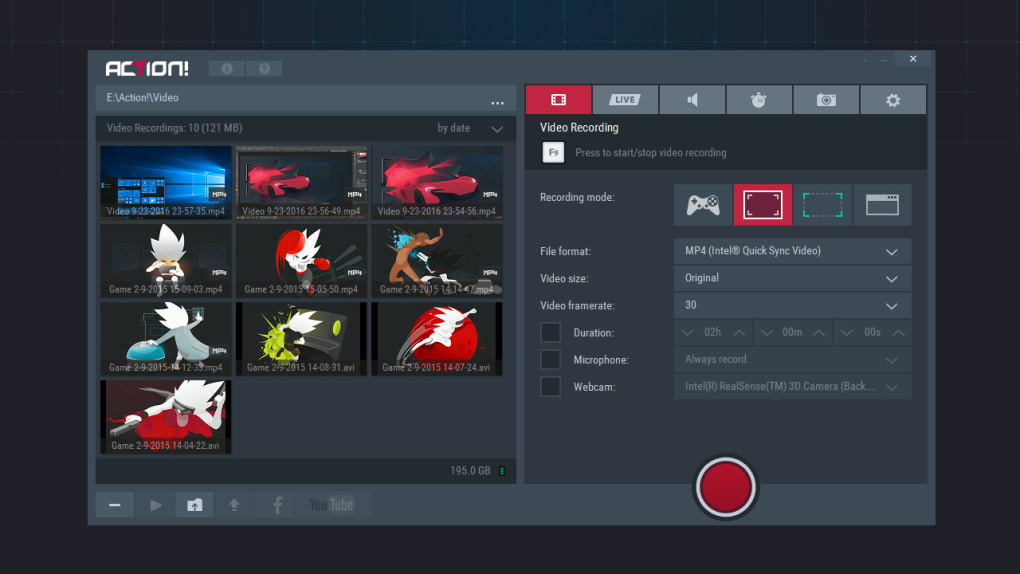

DJI Osmo Action 4 : GoPro dans le viseur - Les Numériques14 Jul 2023 Action! - Download14 Jul 2023

Action! - Download14 Jul 2023 DJI Osmo Action 4 vs GoPro HERO 12 Black, laquelle choisir ?14 Jul 2023

DJI Osmo Action 4 vs GoPro HERO 12 Black, laquelle choisir ?14 Jul 2023

Tu pourrais aussi aimer

Guirlande Lumineuse Série Océan 2m Coquille D'hippocampe - Temu Canada14 Jul 2023

Guirlande Lumineuse Série Océan 2m Coquille D'hippocampe - Temu Canada14 Jul 2023 Rallonge de robinet 3/4'' x 100 mm laiton blanc14 Jul 2023

Rallonge de robinet 3/4'' x 100 mm laiton blanc14 Jul 2023 Soldes Playmobil Hôpital aménagé (70190) 2024 au meilleur prix sur14 Jul 2023

Soldes Playmobil Hôpital aménagé (70190) 2024 au meilleur prix sur14 Jul 2023 GOOACC Lot de 820 clips de fixation et fixations automobiles14 Jul 2023

GOOACC Lot de 820 clips de fixation et fixations automobiles14 Jul 2023 Diffuseur de pare-chocs arrière noir Rieger pour FORD FOCUS MK4 ST / ST-LINE14 Jul 2023

Diffuseur de pare-chocs arrière noir Rieger pour FORD FOCUS MK4 ST / ST-LINE14 Jul 2023 Wishes Come True14 Jul 2023

Wishes Come True14 Jul 2023 Sac de Voyage Pliable, Bagages Cabine Pliable Léger Sac de Voyage Valise sous Siège Rangement Bagage Portable Grande - Noir14 Jul 2023

Sac de Voyage Pliable, Bagages Cabine Pliable Léger Sac de Voyage Valise sous Siège Rangement Bagage Portable Grande - Noir14 Jul 2023 1pc Flotteur De Pêche Électronique, Flotteur De Pêche Lumineux À Led, Bâtons Flottants De Pêche Électroniques Fluorescents, Achetez Plus, Économisez Plus14 Jul 2023

1pc Flotteur De Pêche Électronique, Flotteur De Pêche Lumineux À Led, Bâtons Flottants De Pêche Électroniques Fluorescents, Achetez Plus, Économisez Plus14 Jul 2023 Sentinelle Mini : Traceur GPS Moto Assistance après vol14 Jul 2023

Sentinelle Mini : Traceur GPS Moto Assistance après vol14 Jul 2023 Porte-gobelet en acier inoxydable Choisissez votre modèle Porte14 Jul 2023

Porte-gobelet en acier inoxydable Choisissez votre modèle Porte14 Jul 2023